Implantable Medical Microelectronics Industry Report 2025: Market Size, Innovation Trends, and Strategic Outlook for the Next 5 Years

- Executive Summary & Market Overview

- Key Technology Trends in Implantable Medical Microelectronics

- Competitive Landscape and Leading Players

- Market Growth Forecasts (2025–2030): CAGR, Revenue, and Volume Analysis

- Regional Market Analysis: North America, Europe, Asia-Pacific, and Rest of World

- Future Outlook: Emerging Applications and Investment Hotspots

- Challenges, Risks, and Strategic Opportunities

- Sources & References

Executive Summary & Market Overview

Implantable medical microelectronics represent a rapidly advancing segment of the medical device industry, encompassing miniaturized electronic components designed for permanent or semi-permanent placement within the human body. These devices enable critical functions such as cardiac rhythm management, neurostimulation, drug delivery, and biosensing, driving significant improvements in patient outcomes and quality of life. The global market for implantable medical microelectronics is projected to reach new heights in 2025, fueled by technological innovation, rising prevalence of chronic diseases, and expanding applications in personalized medicine.

According to MarketsandMarkets, the global implantable medical electronics market was valued at approximately USD 21.4 billion in 2023 and is expected to grow at a CAGR of 6.8% through 2025. This growth is underpinned by increasing demand for advanced implantable devices such as pacemakers, cochlear implants, and neurostimulators, as well as the integration of wireless communication and energy harvesting technologies. The North American region continues to dominate the market, attributed to robust healthcare infrastructure, high adoption rates, and strong presence of leading manufacturers including Medtronic, Abbott, and Boston Scientific.

Key market drivers in 2025 include the aging global population, which is increasing the incidence of cardiovascular and neurological disorders, and the growing trend toward minimally invasive procedures. Additionally, regulatory approvals for next-generation devices and the emergence of biocompatible materials are accelerating product development cycles. The integration of artificial intelligence and data analytics into implantable microelectronics is also opening new avenues for remote monitoring and personalized therapy, as highlighted by U.S. Food and Drug Administration (FDA) approvals for AI-enabled cardiac and neuro devices.

However, the market faces challenges such as stringent regulatory requirements, concerns over device cybersecurity, and the high cost of development and implantation. Despite these hurdles, ongoing R&D investments and strategic collaborations between technology firms and healthcare providers are expected to sustain robust market expansion through 2025. As the sector evolves, implantable medical microelectronics are poised to play a pivotal role in the future of digital health and precision medicine.

Key Technology Trends in Implantable Medical Microelectronics

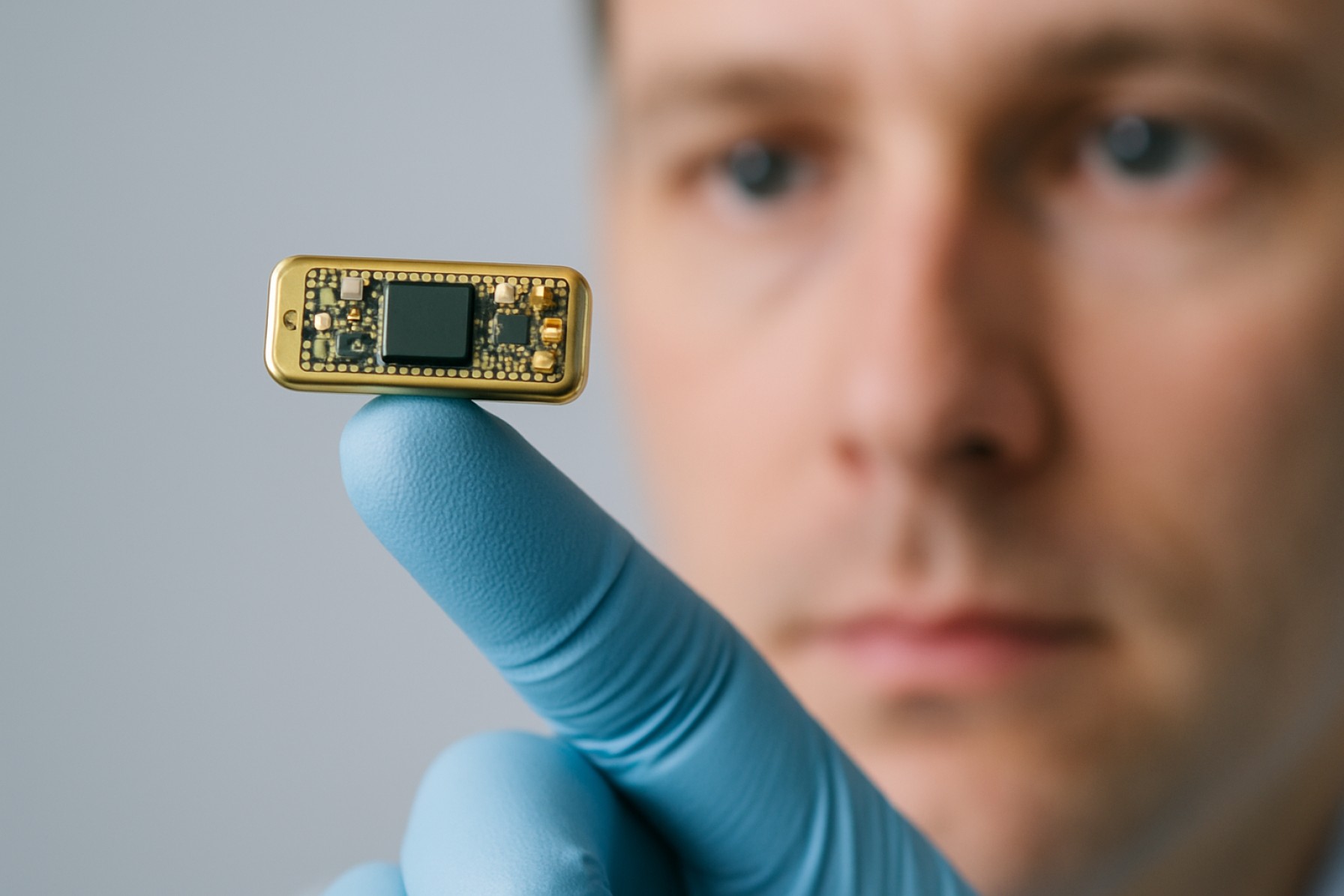

Implantable medical microelectronics are at the forefront of innovation in healthcare, enabling advanced diagnostics, monitoring, and therapeutic interventions directly within the human body. As of 2025, several key technology trends are shaping the evolution and adoption of these devices, driven by the need for miniaturization, enhanced functionality, and improved patient outcomes.

- Miniaturization and Integration: The ongoing trend toward smaller, more integrated circuits is enabling the development of implantable devices with greater functionality and reduced invasiveness. Advances in semiconductor fabrication, such as the use of system-on-chip (SoC) architectures, allow for the integration of sensing, processing, and wireless communication within a single microelectronic package. This trend is exemplified by next-generation cardiac pacemakers and neurostimulators, which are becoming increasingly compact and energy-efficient (Medtronic).

- Wireless Power and Data Transmission: The shift from battery-dependent implants to wirelessly powered devices is accelerating. Technologies such as inductive coupling, radiofrequency (RF) energy transfer, and ultrasound-based power delivery are being refined to extend device lifespans and reduce the need for surgical replacements. Simultaneously, secure wireless data transmission protocols are being developed to enable real-time monitoring and remote programming of implants (Boston Scientific).

- Biocompatible and Flexible Materials: The adoption of advanced materials, including biocompatible polymers, ceramics, and flexible electronics, is enhancing the safety and comfort of implantable devices. These materials reduce the risk of immune response and allow for conformal contact with biological tissues, which is particularly important for applications such as brain-machine interfaces and subcutaneous sensors (Abbott Laboratories).

- Artificial Intelligence and Edge Computing: The integration of AI algorithms and edge computing capabilities within implantable microelectronics is enabling real-time data analysis and adaptive therapy. For example, closed-loop neuromodulation systems can now adjust stimulation parameters autonomously based on patient-specific feedback, improving therapeutic efficacy and reducing side effects (St. Jude Medical).

- Cybersecurity and Data Privacy: As connectivity increases, so does the importance of robust cybersecurity measures. Manufacturers are implementing advanced encryption and authentication protocols to protect sensitive patient data and prevent unauthorized access to implantable devices (U.S. Food and Drug Administration).

These technology trends are collectively driving the next wave of innovation in implantable medical microelectronics, with significant implications for patient care, device longevity, and the broader digital health ecosystem.

Competitive Landscape and Leading Players

The competitive landscape of the implantable medical microelectronics market in 2025 is characterized by a mix of established medical device giants, specialized microelectronics firms, and innovative startups. The sector is driven by rapid technological advancements, increasing demand for minimally invasive procedures, and the growing prevalence of chronic diseases requiring long-term monitoring and therapy.

Key players dominate the market through extensive R&D investments, strategic partnerships, and robust intellectual property portfolios. Medtronic remains a global leader, leveraging its broad portfolio of implantable devices such as pacemakers, neurostimulators, and drug delivery systems. The company’s focus on miniaturization and wireless communication technologies has reinforced its competitive edge. Abbott Laboratories is another major player, particularly strong in cardiac rhythm management and neuromodulation devices, with a growing emphasis on integrating advanced microelectronics for improved device longevity and patient outcomes.

Other significant contributors include Boston Scientific Corporation, which has expanded its implantable device offerings through acquisitions and in-house innovation, and BIOTRONIK, known for its expertise in cardiac and vascular implants. Microchip Technology Inc. and STMicroelectronics play crucial roles as suppliers of specialized microelectronic components, supporting device manufacturers with custom integrated circuits and sensors tailored for medical applications.

- Emerging Players: Startups such as Neuralink and CorTec are pushing the boundaries of brain-computer interfaces and neural implants, introducing novel microelectronic architectures and biocompatible materials.

- Strategic Collaborations: Partnerships between device manufacturers and semiconductor companies are accelerating innovation. For example, Medtronic has collaborated with Qualcomm to enhance wireless connectivity in implantable devices.

- Regional Dynamics: North America and Europe remain the largest markets, but Asia-Pacific is witnessing rapid growth due to increased healthcare investments and local manufacturing capabilities, with companies like LivaNova expanding their regional presence.

Overall, the 2025 market is marked by intense competition, with leading players focusing on technological differentiation, regulatory compliance, and strategic alliances to maintain and grow their market share in implantable medical microelectronics.

Market Growth Forecasts (2025–2030): CAGR, Revenue, and Volume Analysis

The global market for implantable medical microelectronics is poised for robust growth between 2025 and 2030, driven by technological advancements, rising prevalence of chronic diseases, and increasing demand for minimally invasive medical devices. According to projections by Fortune Business Insights, the implantable medical devices market—which includes microelectronic components—is expected to register a compound annual growth rate (CAGR) of approximately 6.5% during this period. This growth is underpinned by the expanding adoption of microelectronic-enabled devices such as pacemakers, neurostimulators, cochlear implants, and implantable drug delivery systems.

Revenue forecasts indicate that the global market value for implantable medical microelectronics will surpass $60 billion by 2030, up from an estimated $43 billion in 2025. This surge is attributed to the integration of advanced microelectronic technologies, such as wireless communication modules, miniaturized sensors, and energy-efficient power management systems, which enhance device functionality and patient outcomes. MarketsandMarkets highlights that the neurostimulators and cardiac rhythm management segments will be the primary revenue drivers, owing to the growing incidence of neurological and cardiovascular disorders globally.

In terms of volume, the number of implantable medical microelectronic units shipped is expected to grow at a CAGR of 7–8% from 2025 to 2030. This increase is fueled by greater accessibility to healthcare in emerging markets, rising geriatric populations, and ongoing product innovations. Grand View Research notes that Asia-Pacific will experience the fastest volume growth, with China and India emerging as key markets due to their large patient bases and improving healthcare infrastructure.

- CAGR (2025–2030): 6.5% (revenue), 7–8% (volume)

- Revenue Forecast (2030): $60+ billion

- Key Growth Drivers: Technological innovation, chronic disease prevalence, minimally invasive procedures

- Leading Segments: Neurostimulators, cardiac rhythm management, cochlear implants

- Fastest-Growing Region: Asia-Pacific

Overall, the implantable medical microelectronics market is set for significant expansion through 2030, with both established and emerging markets contributing to increased adoption and innovation.

Regional Market Analysis: North America, Europe, Asia-Pacific, and Rest of World

The global market for implantable medical microelectronics is characterized by significant regional variations, driven by differences in healthcare infrastructure, regulatory environments, and adoption rates of advanced medical technologies. In 2025, North America, Europe, Asia-Pacific, and the Rest of the World (RoW) each present distinct market dynamics and growth opportunities.

- North America: North America remains the largest market for implantable medical microelectronics, underpinned by robust healthcare spending, a high prevalence of chronic diseases, and a strong innovation ecosystem. The United States, in particular, benefits from favorable reimbursement policies and a well-established regulatory framework, which accelerates the adoption of devices such as pacemakers, neurostimulators, and cochlear implants. According to U.S. Food and Drug Administration (FDA) data, the region continues to see a steady pipeline of approvals for next-generation implantable devices, supporting market expansion.

- Europe: Europe is the second-largest market, with growth driven by increasing investments in healthcare technology and a rising geriatric population. Countries such as Germany, France, and the UK are at the forefront, supported by strong public healthcare systems and ongoing research initiatives. The European Commission’s Medical Device Regulation (MDR) has introduced more stringent requirements, which, while increasing compliance costs, are expected to enhance patient safety and foster innovation in microelectronic implants.

- Asia-Pacific: The Asia-Pacific region is projected to witness the fastest growth through 2025, fueled by expanding healthcare access, rising disposable incomes, and increasing awareness of advanced medical treatments. Major markets such as China, Japan, and India are investing heavily in healthcare infrastructure and local manufacturing capabilities. According to Mordor Intelligence, the region’s large patient pool and government initiatives to modernize healthcare systems are key drivers for the rapid adoption of implantable microelectronics.

- Rest of World (RoW): The RoW segment, encompassing Latin America, the Middle East, and Africa, is experiencing gradual growth. Market expansion is primarily limited by lower healthcare expenditure and limited access to advanced medical technologies. However, increasing investments in healthcare infrastructure and partnerships with global device manufacturers are expected to improve market penetration over the forecast period, as noted by Grand View Research.

Overall, while North America and Europe lead in terms of market size and technological advancement, Asia-Pacific is emerging as a key growth engine for implantable medical microelectronics in 2025, with the Rest of the World showing potential for long-term development.

Future Outlook: Emerging Applications and Investment Hotspots

The future outlook for implantable medical microelectronics in 2025 is marked by rapid innovation, expanding clinical applications, and a surge in investment activity. As the convergence of miniaturization, wireless communication, and advanced materials accelerates, the sector is poised to address unmet medical needs and transform patient care across multiple domains.

Emerging Applications

- Neuromodulation and Brain-Computer Interfaces (BCIs): Next-generation implantable devices are enabling more precise neuromodulation for conditions such as epilepsy, Parkinson’s disease, and chronic pain. BCIs are advancing toward clinical viability, with companies like Neuralink and Synchron developing minimally invasive systems for restoring communication and mobility in paralyzed patients.

- Cardiac and Vascular Implants: Leadless pacemakers, implantable loop recorders, and smart stents are gaining traction, offering improved patient comfort and real-time monitoring. Medtronic and Abbott are expanding their portfolios with devices that integrate wireless telemetry and AI-driven diagnostics.

- Closed-Loop Drug Delivery: Microelectronic implants capable of sensing physiological parameters and delivering drugs on demand are under development for diabetes, chronic pain, and oncology. Insulet Corporation and Dexcom are among the leaders in integrating biosensors with therapeutic delivery systems.

- Hearing and Vision Restoration: Cochlear and retinal implants are evolving with higher channel counts and wireless power, improving outcomes for sensory impairments. Cochlear Limited and Second Sight Medical Products are at the forefront of these advancements.

Investment Hotspots

- Venture Capital and M&A: The sector is attracting robust venture capital, with global investment in neurotechnology and smart implants surpassing $2.5 billion in 2023 and projected to grow further in 2025 (CB Insights).

- Geographic Focus: North America and Western Europe remain dominant, but Asia-Pacific—especially China and Singapore—is emerging as a key innovation and manufacturing hub (Frost & Sullivan).

- Strategic Partnerships: Collaborations between medtech firms, academic institutions, and semiconductor companies are accelerating R&D and commercialization, as seen in alliances involving Intel and TSMC for custom microelectronic components.

In summary, 2025 will see implantable medical microelectronics move beyond traditional applications, with investment flowing into platforms that promise personalized, connected, and minimally invasive therapies.

Challenges, Risks, and Strategic Opportunities

The implantable medical microelectronics sector faces a complex landscape of challenges and risks in 2025, but these also create avenues for strategic opportunities. One of the foremost challenges is the stringent regulatory environment. Regulatory bodies such as the U.S. Food and Drug Administration (FDA) and the European Commission have heightened requirements for safety, biocompatibility, and cybersecurity, leading to longer approval timelines and increased R&D costs. This is particularly significant as devices become more sophisticated, integrating wireless communication and advanced sensors.

Cybersecurity risks are escalating as implantable devices increasingly rely on wireless connectivity for data transmission and remote monitoring. Vulnerabilities in device software can expose patients to data breaches or even malicious interference, prompting the need for robust encryption and real-time threat detection systems. The FDA has issued new guidance on cybersecurity for medical devices, compelling manufacturers to invest in advanced security protocols.

Supply chain disruptions, exacerbated by global events and semiconductor shortages, continue to threaten timely production and delivery. The reliance on specialized microelectronic components, often sourced from a limited number of suppliers, increases the risk of bottlenecks. According to McKinsey & Company, companies are now exploring vertical integration and strategic partnerships to mitigate these risks and ensure supply chain resilience.

Despite these challenges, significant strategic opportunities are emerging. The growing prevalence of chronic diseases and the aging global population are driving demand for advanced implantable devices, such as neurostimulators, cardiac rhythm management devices, and drug delivery systems. Innovations in materials science, such as the use of biocompatible polymers and miniaturized batteries, are enabling the development of smaller, longer-lasting implants. Furthermore, the integration of artificial intelligence and machine learning into device firmware is opening new possibilities for personalized therapy and predictive diagnostics.

- Strategic collaborations between device manufacturers and technology firms are accelerating innovation cycles.

- Expansion into emerging markets, where healthcare infrastructure is rapidly improving, offers new growth avenues.

- Investment in cybersecurity and regulatory expertise is becoming a key differentiator for market leaders.

In summary, while the implantable medical microelectronics market in 2025 is fraught with regulatory, cybersecurity, and supply chain risks, proactive strategies and technological innovation are unlocking substantial growth opportunities for forward-thinking companies.

Sources & References

- MarketsandMarkets

- Medtronic

- Boston Scientific

- BIOTRONIK

- STMicroelectronics

- Neuralink

- CorTec

- Qualcomm

- LivaNova

- Fortune Business Insights

- Grand View Research

- European Commission

- Mordor Intelligence

- Neuralink

- Synchron

- Insulet Corporation

- Dexcom

- Cochlear Limited

- Second Sight Medical Products

- Frost & Sullivan

- McKinsey & Company