Microfluidic Vesicle Fabrication Industry Report 2025: Market Dynamics, Technology Advances, and Strategic Opportunities. Explore Key Trends, Regional Insights, and Growth Projections Through 2030.

- Executive Summary & Market Overview

- Key Technology Trends in Microfluidic Vesicle Fabrication

- Competitive Landscape and Leading Players

- Market Growth Forecasts and CAGR Analysis (2025–2030)

- Regional Market Analysis: North America, Europe, Asia-Pacific & Rest of World

- Future Outlook: Emerging Applications and Investment Hotspots

- Challenges, Risks, and Strategic Opportunities

- Sources & References

Executive Summary & Market Overview

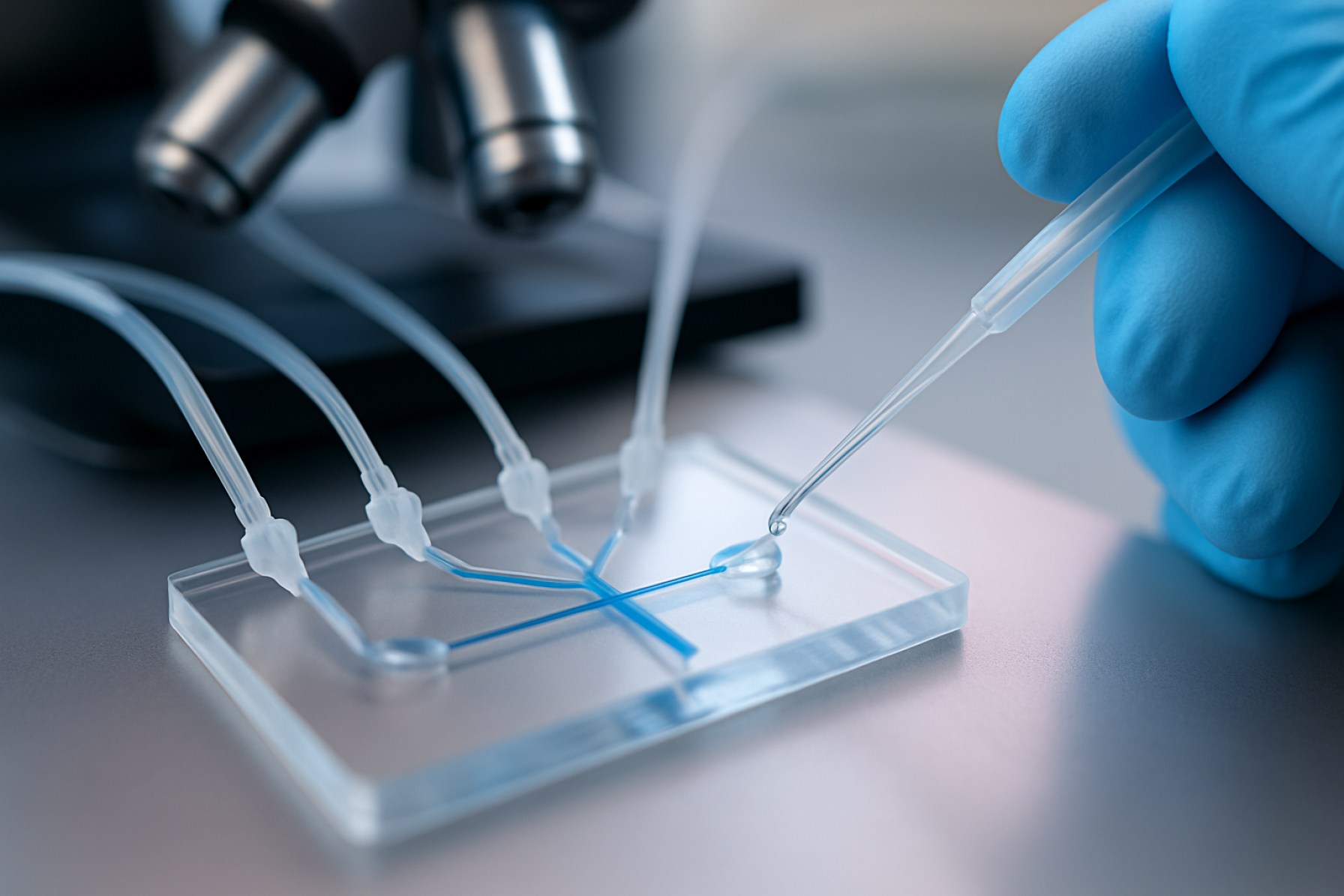

Microfluidic vesicle fabrication refers to the use of microfluidic technologies to produce vesicles—small, membrane-bound compartments such as liposomes, polymersomes, and other artificial cell-like structures. These vesicles are critical in drug delivery, diagnostics, synthetic biology, and cosmetics due to their ability to encapsulate and release active agents in a controlled manner. The microfluidic approach offers superior control over vesicle size, uniformity, and composition compared to traditional bulk methods, driving its adoption across research and commercial sectors.

In 2025, the global market for microfluidic vesicle fabrication is experiencing robust growth, propelled by increasing demand for precision drug delivery systems, advancements in personalized medicine, and the expanding field of synthetic biology. According to Grand View Research, the broader microfluidics market is projected to reach USD 42.2 billion by 2030, with vesicle fabrication representing a significant and rapidly expanding segment within this space. The technology’s ability to produce monodisperse vesicles at high throughput is particularly attractive for pharmaceutical companies seeking scalable solutions for encapsulation and targeted delivery.

Key industry players such as Dolomite Microfluidics, Sphere Fluidics, and Fluidigm Corporation are at the forefront, offering specialized microfluidic platforms and consumables tailored for vesicle production. These companies are investing in R&D to enhance device automation, integration with analytical tools, and compatibility with a wider range of biomaterials. The market is also witnessing increased collaboration between academic institutions and industry, accelerating the translation of microfluidic vesicle fabrication from laboratory research to commercial manufacturing.

Geographically, North America and Europe dominate the market due to strong biotechnology and pharmaceutical sectors, supportive regulatory frameworks, and significant funding for life sciences innovation. However, Asia-Pacific is emerging as a high-growth region, driven by expanding healthcare infrastructure and rising investment in biomanufacturing capabilities, particularly in China, Japan, and South Korea (MarketsandMarkets).

Overall, the microfluidic vesicle fabrication market in 2025 is characterized by technological innovation, increasing commercialization, and a growing emphasis on scalable, reproducible, and customizable vesicle production solutions to meet the evolving needs of the pharmaceutical, biotechnology, and diagnostics industries.

Key Technology Trends in Microfluidic Vesicle Fabrication

Microfluidic vesicle fabrication is experiencing rapid technological evolution, driven by the demand for precise, scalable, and reproducible production of vesicles for applications in drug delivery, diagnostics, and synthetic biology. In 2025, several key technology trends are shaping the landscape of this field:

- Integration of Advanced Materials: The adoption of novel polymers and lipid analogs is enhancing vesicle stability and functionality. Materials such as PEGylated lipids and stimuli-responsive polymers are being incorporated into microfluidic platforms to produce vesicles with tunable properties, improving their suitability for targeted drug delivery and biosensing applications (Nature Nanotechnology).

- Parallelization and High-Throughput Systems: To meet industrial-scale demands, microfluidic devices are increasingly designed with parallelized channels and multiplexed droplet generators. This enables the simultaneous production of millions of uniform vesicles per hour, significantly reducing costs and time-to-market for pharmaceutical and biotechnology companies (Trends in Biotechnology).

- Digital Microfluidics and Automation: The integration of digital microfluidics—where droplets are manipulated by electric fields on programmable surfaces—is enabling automated, on-demand vesicle synthesis. This trend is facilitating rapid prototyping and personalized medicine approaches, as vesicle formulations can be dynamically adjusted in real time (Labcyte).

- On-Chip Characterization and Quality Control: New microfluidic platforms are embedding real-time analytical tools, such as fluorescence-based sizing and sorting, directly on-chip. This allows for immediate quality assessment and sorting of vesicles by size, lamellarity, or encapsulation efficiency, streamlining downstream processing (Dolomite Microfluidics).

- Green and Sustainable Fabrication Methods: There is a growing emphasis on solvent-free and energy-efficient microfluidic processes. Innovations include the use of aqueous two-phase systems and biodegradable materials, aligning with global sustainability goals and regulatory requirements (Elsevier).

These trends are collectively advancing the microfluidic vesicle fabrication market, enabling more sophisticated, scalable, and sustainable solutions for next-generation biomedical applications.

Competitive Landscape and Leading Players

The competitive landscape of the microfluidic vesicle fabrication market in 2025 is characterized by a dynamic mix of established technology providers, innovative startups, and academic spin-offs, all vying for leadership in a rapidly evolving field. The market is driven by the growing demand for precision drug delivery systems, advanced diagnostics, and synthetic biology applications, which require highly controlled and scalable vesicle production.

Key players in this sector include Dolomite Microfluidics, a pioneer in microfluidic technology, offering modular systems for the production of monodisperse liposomes and polymersomes. Their solutions are widely adopted in pharmaceutical R&D and have set industry benchmarks for reproducibility and scalability. Sphere Fluidics is another prominent company, specializing in single-cell analysis and microfluidic droplet systems, which are increasingly used for vesicle encapsulation and screening applications.

Emerging players such as Fluidic Analytics and Elvesys are leveraging proprietary chip designs and automation to enhance throughput and reduce costs, targeting both research and commercial manufacturing markets. Academic spin-offs, notably from institutions like MIT and ETH Zurich, are also contributing disruptive innovations, particularly in the area of synthetic cell and artificial organelle fabrication.

Strategic collaborations and licensing agreements are common, as companies seek to integrate complementary technologies and expand their application portfolios. For example, partnerships between microfluidic device manufacturers and pharmaceutical companies are accelerating the translation of vesicle-based therapeutics from bench to bedside. Additionally, several players are investing in cloud-based data analytics and AI-driven process optimization to further differentiate their offerings.

- Dolomite Microfluidics: Market leader in modular microfluidic systems for vesicle production.

- Sphere Fluidics: Specialist in droplet microfluidics for encapsulation and screening.

- Fluidic Analytics: Innovator in chip-based analytics and vesicle characterization.

- Elvesys: Provider of high-throughput microfluidic platforms.

Overall, the competitive landscape in 2025 is marked by rapid technological advancements, increasing patent activity, and a strong focus on application-driven innovation. Companies that can offer integrated, scalable, and user-friendly solutions are expected to maintain a competitive edge as the market continues to expand.

Market Growth Forecasts and CAGR Analysis (2025–2030)

The global market for microfluidic vesicle fabrication is poised for robust growth between 2025 and 2030, driven by increasing demand for precision drug delivery systems, advancements in lab-on-a-chip technologies, and the expanding applications of vesicles in diagnostics and therapeutics. According to projections by MarketsandMarkets, the broader microfluidics market is expected to achieve a compound annual growth rate (CAGR) of approximately 16% during this period, with the vesicle fabrication segment anticipated to outpace the average due to its critical role in next-generation biomedical applications.

Key growth drivers include the rising adoption of lipid nanoparticles and liposomes for mRNA vaccine delivery, as evidenced by the success of COVID-19 vaccines, and the growing interest in exosome-based diagnostics and therapeutics. The microfluidic approach offers superior control over vesicle size, uniformity, and encapsulation efficiency compared to traditional bulk methods, making it increasingly attractive for pharmaceutical and biotechnology companies. Grand View Research highlights that the pharmaceutical and life sciences sectors are expected to account for the largest share of new investments in microfluidic vesicle fabrication technologies through 2030.

Regionally, North America and Europe are projected to maintain their dominance due to strong R&D infrastructure, significant funding, and the presence of leading industry players such as Dolomite Microfluidics and Sphere Fluidics. However, the Asia-Pacific region is forecasted to exhibit the fastest CAGR, propelled by increasing government initiatives, expanding biotech sectors, and growing collaborations between academic institutions and industry.

- Estimated CAGR for microfluidic vesicle fabrication (2025–2030): 17–19%.

- Market value projection for 2030: Expected to surpass USD 1.2 billion, up from an estimated USD 500 million in 2025 (MarketsandMarkets).

- Key application growth areas: mRNA therapeutics, targeted drug delivery, and liquid biopsy diagnostics.

In summary, the microfluidic vesicle fabrication market is set for accelerated expansion through 2030, underpinned by technological innovation, expanding biomedical applications, and increasing investment from both public and private sectors.

Regional Market Analysis: North America, Europe, Asia-Pacific & Rest of World

The global market for microfluidic vesicle fabrication is experiencing dynamic growth, with regional trends shaped by technological innovation, regulatory environments, and end-user demand. In 2025, North America, Europe, Asia-Pacific, and the Rest of the World (RoW) each present distinct opportunities and challenges for stakeholders in this sector.

North America remains the leading region, driven by robust investments in biotechnology and pharmaceutical R&D. The United States, in particular, benefits from a concentration of key players, advanced research institutions, and supportive funding from agencies such as the National Institutes of Health. The region’s focus on drug delivery, diagnostics, and personalized medicine is accelerating the adoption of microfluidic vesicle fabrication technologies. According to Grand View Research, North America accounted for over 35% of the global microfluidics market share in 2024, a trend expected to continue into 2025.

Europe is characterized by strong regulatory frameworks and collaborative research initiatives. Countries like Germany, the UK, and France are at the forefront, leveraging EU-funded projects and partnerships between academia and industry. The European Commission has prioritized microfluidics in its Horizon Europe program, fostering innovation in vesicle fabrication for applications in therapeutics and diagnostics. The region’s emphasis on quality standards and patient safety is shaping the development and commercialization of new microfluidic platforms.

Asia-Pacific is witnessing the fastest growth, propelled by expanding healthcare infrastructure, rising investments in life sciences, and a burgeoning biotechnology sector. China, Japan, and South Korea are leading adopters, with government initiatives supporting advanced manufacturing and translational research. According to MarketsandMarkets, the Asia-Pacific microfluidics market is projected to grow at a CAGR exceeding 15% through 2025, outpacing other regions. Local companies are increasingly collaborating with global players to accelerate technology transfer and commercialization.

- Rest of the World (RoW) includes Latin America, the Middle East, and Africa, where adoption is slower but rising. Growth is driven by increasing awareness of microfluidic technologies and gradual improvements in research funding and healthcare infrastructure. Brazil and South Africa are emerging as regional hubs, with academic and government support for biotechnology innovation.

Overall, regional disparities in regulatory policies, funding, and market maturity will continue to shape the competitive landscape for microfluidic vesicle fabrication in 2025.

Future Outlook: Emerging Applications and Investment Hotspots

The future outlook for microfluidic vesicle fabrication in 2025 is marked by rapid expansion into new application domains and a surge in investment activity, driven by the technology’s unique ability to produce highly uniform, scalable, and customizable vesicles. As pharmaceutical, biotechnology, and diagnostics industries increasingly demand precision drug delivery systems and advanced biomimetic models, microfluidic vesicle fabrication is positioned as a critical enabling technology.

Emerging applications are particularly prominent in the development of next-generation drug delivery vehicles, such as lipid nanoparticles (LNPs) for mRNA vaccines and gene therapies. The success of mRNA COVID-19 vaccines has accelerated R&D in this area, with companies like Moderna and Pfizer investing in microfluidic platforms to optimize LNP production for improved efficacy and safety profiles. Additionally, microfluidic vesicle fabrication is gaining traction in the creation of artificial cells and organ-on-chip systems, which are essential for high-throughput drug screening and disease modeling. Startups and established players alike are leveraging microfluidics to produce vesicles that closely mimic natural cellular environments, enhancing the predictive power of preclinical studies (Grand View Research).

Diagnostics is another hotspot, with microfluidic vesicles being used as carriers for biosensors and reagents in point-of-care testing devices. The ability to encapsulate and release reagents in a controlled manner is revolutionizing rapid diagnostic platforms, particularly for infectious diseases and personalized medicine (MarketsandMarkets).

From an investment perspective, venture capital and strategic corporate funding are flowing into microfluidic technology developers, especially those focused on scalable manufacturing solutions. The Asia-Pacific region, led by China and Singapore, is emerging as a significant investment hotspot due to robust government support, a growing biotech ecosystem, and increasing demand for advanced healthcare solutions (Frost & Sullivan). North America and Europe continue to see strong activity, with collaborations between academic institutions and industry players accelerating commercialization timelines.

In summary, 2025 is expected to witness microfluidic vesicle fabrication transitioning from niche research to mainstream industrial adoption, with the most dynamic growth in drug delivery, synthetic biology, and diagnostics. The convergence of technological innovation and strategic investment is set to unlock new market opportunities and drive the next wave of biomedical breakthroughs.

Challenges, Risks, and Strategic Opportunities

Microfluidic vesicle fabrication, a cornerstone technology for drug delivery, diagnostics, and synthetic biology, faces a complex landscape of challenges and risks in 2025, but also presents significant strategic opportunities for innovators and investors.

Challenges and Risks

- Scalability and Throughput: While microfluidic platforms offer precise control over vesicle size and composition, scaling up production to meet commercial demand remains a major hurdle. Most current systems are optimized for laboratory-scale outputs, and transitioning to industrial-scale manufacturing without compromising quality or uniformity is technically demanding and capital-intensive (Nature Reviews Materials).

- Reproducibility and Standardization: Variability in device fabrication, fluid dynamics, and reagent quality can lead to batch-to-batch inconsistencies. The lack of universally accepted standards for vesicle characterization further complicates regulatory approval and market adoption (U.S. Food and Drug Administration).

- Material Compatibility and Fouling: The choice of materials for microfluidic chips (e.g., PDMS, glass, thermoplastics) affects vesicle yield and purity. Issues such as channel fouling, adsorption of biomolecules, and chemical incompatibility can reduce device lifespan and increase operational costs (Biosensors and Bioelectronics).

- Regulatory and IP Complexity: Navigating the intellectual property landscape is challenging due to overlapping patents and proprietary technologies. Regulatory pathways for microfluidic-produced vesicles, especially for therapeutic use, are still evolving, creating uncertainty for market entrants (European Medicines Agency).

Strategic Opportunities

- Integration with Automation and AI: Incorporating automation and artificial intelligence into microfluidic workflows can enhance reproducibility, optimize process parameters, and enable real-time quality control, addressing key scalability and consistency issues (McKinsey & Company).

- Custom and On-Demand Vesicle Production: The ability to rapidly prototype and produce vesicles tailored to specific applications (e.g., personalized medicine, targeted drug delivery) positions microfluidic fabrication as a disruptive force in precision healthcare (Boston Consulting Group).

- Collaborative Ecosystems: Partnerships between device manufacturers, pharmaceutical companies, and academic institutions can accelerate technology transfer, standardization, and regulatory alignment, unlocking new market segments and applications (Deloitte).

In summary, while microfluidic vesicle fabrication in 2025 is constrained by technical, regulatory, and operational risks, strategic investments in automation, customization, and cross-sector collaboration offer pathways to overcome these barriers and capture emerging market opportunities.

Sources & References

- Grand View Research

- Dolomite Microfluidics

- Sphere Fluidics

- MarketsandMarkets

- Nature Nanotechnology

- Elsevier

- Fluidic Analytics

- Elvesys

- National Institutes of Health

- European Commission

- Frost & Sullivan

- European Medicines Agency

- McKinsey & Company

- Deloitte